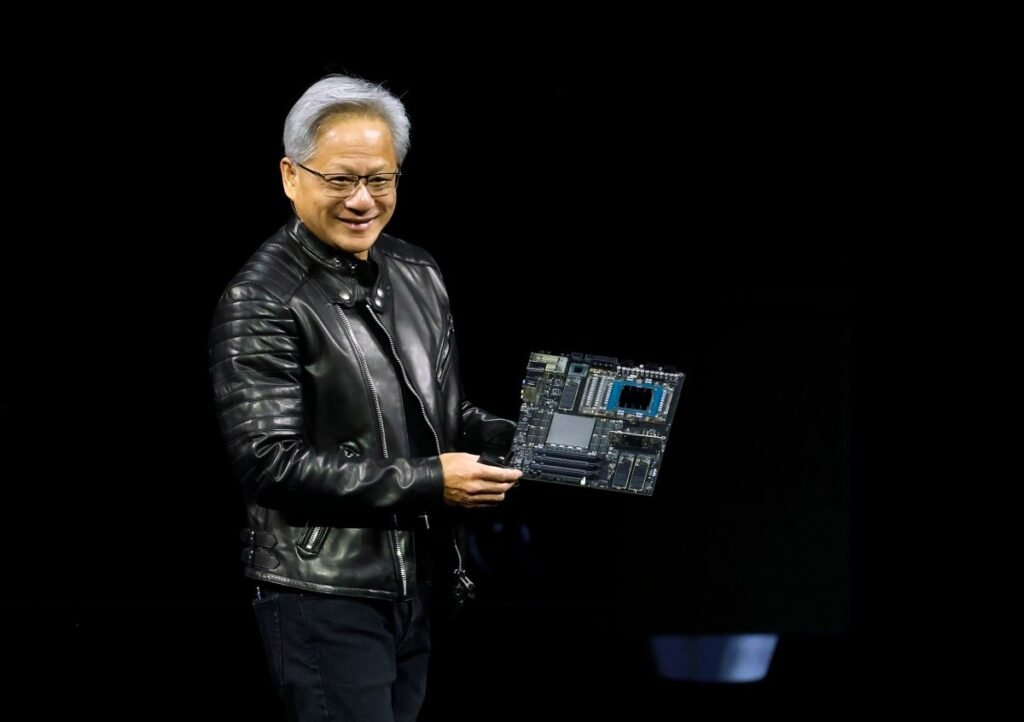

Nvidia founder and CEO Jensen Huang struck a bullish tone within the firm’s third-quarter earnings. And primarily based on the corporate’s outcomes, there could also be motive to.

Nvidia reported income of $57 billion within the third quarter, 62% greater in comparison with the identical quarter final 12 months. The corporate’s web earnings on a GAAP foundation was $32 billion, 65% greater year-over-year. Each income and revenue outcomes beat Wall Avenue expectations.

The income image exhibits an organization booming thanks largely to its knowledge middle enterprise. Income generated by Nvidia’s knowledge middle enterprise was a file $51.2 billion, up 25% from the earlier quarter and up 66% from a 12 months in the past. The remaining $5.8 billion in income got here from Nvidia’s gaming enterprise with $4.2 billion, adopted by gross sales in skilled visualization and automotive.

Nvidia’s CFO Colette Kress noted in a statement to shareholders its knowledge middle enterprise has been fueled by an acceleration of computing, highly effective AI fashions, and agentic functions. In the course of the firm’s Q3 name, Kress stated on this previous quarter, the corporate introduced AI manufacturing facility and infrastructure tasks amounting to an combination of 5 million GPUs.

“This demand spans each market, CSPs, sovereigns, trendy builders enterprises and tremendous computing facilities, and consists of a number of landmark construct outs,” Kress stated.

Blackwell Extremely, a GPU unveiled in March and obtainable in a number of configurations, has been notably sturdy and is now the chief inside the firm. Earlier variations of the Blackwell structure additionally noticed continued sturdy demand, in line with the corporate.

Huang stated gross sales of its Blackwell GPU chips “are off the charts.”

Techcrunch occasion

San Francisco

|

October 13-15, 2026

“Blackwell gross sales are off the charts, and cloud GPUs are offered out,” Huang stated within the firm’s Q3 earnings assertion. “Compute demand retains accelerating and compounding throughout coaching and inference — every rising exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling quick — with extra new basis mannequin makers, extra AI startups, throughout extra industries, and in additional international locations. AI goes all over the place, doing all the pieces, suddenly.”

Kress did notice that the corporate’s shipments of H20, a knowledge middle GPU designed for generative AI and high-performance computing, had been 50 million, a disappointing consequence attributable to its incapacity to promote to China.

“Sizable buy orders by no means materialized within the quarter attributable to geopolitical points and the more and more aggressive market in China,,” Kress famous on the earnings name. “Whereas we had been disillusioned within the present state that stops us from delivery extra aggressive knowledge middle compute merchandise to China, we’re dedicated to continued engagement with the U.S. and China governments, and can proceed to advocate for America’s means to compete all over the world.”

Importantly, Nvidia is forecasting extra progress with a projected income of $65 billion within the fourth quarter, serving to push its share worth up greater than 4% in after-hours buying and selling.

The upshot, at the least in Huang’s view: neglect in regards to the bubble, there’s solely progress.

“There’s been a whole lot of speak about an AI bubble,” Jensen stated in the course of the firm’s earnings name. “From our vantage level, we see one thing very totally different.”