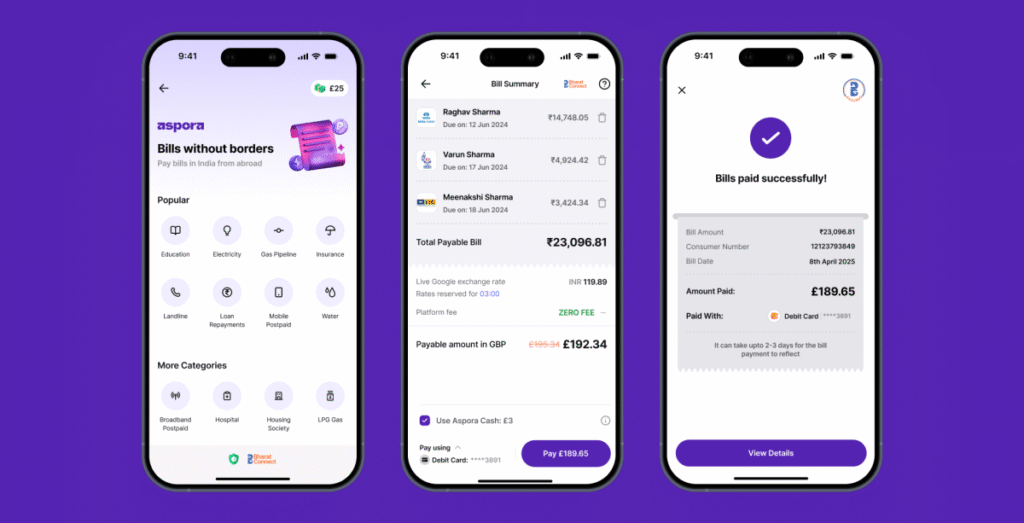

Sequoia-backed fintech platform Aspora, which lets the Indian diaspora ship a refund to India, is launching a brand new characteristic for customers to pay payments. This implies Non-Resident Indians (NRIs) will pay utility payments or recharge their cellular pay as you go plans for his or her household.

The startup mentioned that till now, customers needed to both switch the cash to their Indian accounts or ask somebody to deal with the payments for them. The opposite possibility for them was to make use of their international playing cards and attempt to pay payments whereas going through excessive costs and cost failures.

Aspora has hooked as much as the Bharat Invoice Cost System (BBPS), which handles invoice funds in India, utilizing Sure Financial institution’s home pipeline. By way of this method, it has enabled cost for greater than 22,000 billers in India, starting from electrical energy suppliers resembling BSES and BESCOM, broadband suppliers like Jio and Airtel, and mortgage funds for main banks.

The startup mentioned it’s not charging any charges for these funds, and the customers get one of the best change charges to pay the invoice instantly in international forex.

“For hundreds of thousands of Indians residing abroad, paying payments in India has at all times been unnecessarily advanced – involving transfers, delays, and double charges. Aspora has now solved this large-scale downside on the faucet of a button”, Aspora founder and CEO Parth Garg advised TechCrunch in a latest cellphone interview.

Garg mentioned invoice funds would possibly cut back remittances, however solely by 4% to five% of whole transfers. Garg believes giving customers the power to pay payments will create long-term stickiness.

“Right now, the aim for any Neo financial institution is to attempt to get an increasing number of transactions in your app. With remittances, folks used to make use of the app a few times a month. Due to this new invoice cost system. The brand new characteristic will increase velocity on our platform and has our customers go to the platform extra regularly,” Garg talked about.

Techcrunch occasion

San Francisco

|

October 13-15, 2026

He mentioned Aspora has been testing this characteristic with just a few thousand customers for a a number of weeks now, and it has seen optimistic outcomes. The startup famous that cellular recharges have been a giant use case that emerged out of this check. BBPS doesn’t help some classes, like cellular recharge or bank card funds for international payers. That’s the reason Apsora has partnered with worldwide cellular recharge firm Ding to facilitate these transactions.

The characteristic is out there for patrons within the UK, and the corporate plans to make it accessible to customers within the U.S. and the United Arab Emirates (UAE) quickly.

In June, Aspora raised $50 million in Sequence B funding at a $500 million valuation, led by Sequoia. Different buyers Greylock, Hummingbird, Quantum Mild Ventures, and Y Combinator additionally contributed to the spherical. The corporate has raised greater than $99 million in funding up to now. The startup opened up its providers in July to NRIs within the U.S. market, which accounts for the highest inward remittance marketplace for India, with nearly 28% market share according to the country’s central bank.

Aspora has now reached 800,000 clients, who’ve accomplished transactions of $4 billion and saved $25 million in switch charges, in response to the corporate.

Aspora goals to launch NRE (Non-Resident Exterior) accounts to let customers handle international revenue and NRO (Non-Resident Bizarre) accounts to let customers handle incoming earned in India subsequent 12 months.